Business Insolvency Company Specialists: Helping You Get Rid Of Financial Challenges

Business Insolvency Company Specialists: Helping You Get Rid Of Financial Challenges

Blog Article

Delve Into the Intricacies of Bankruptcy Providers and Just How They Can Provide the Assistance You Required

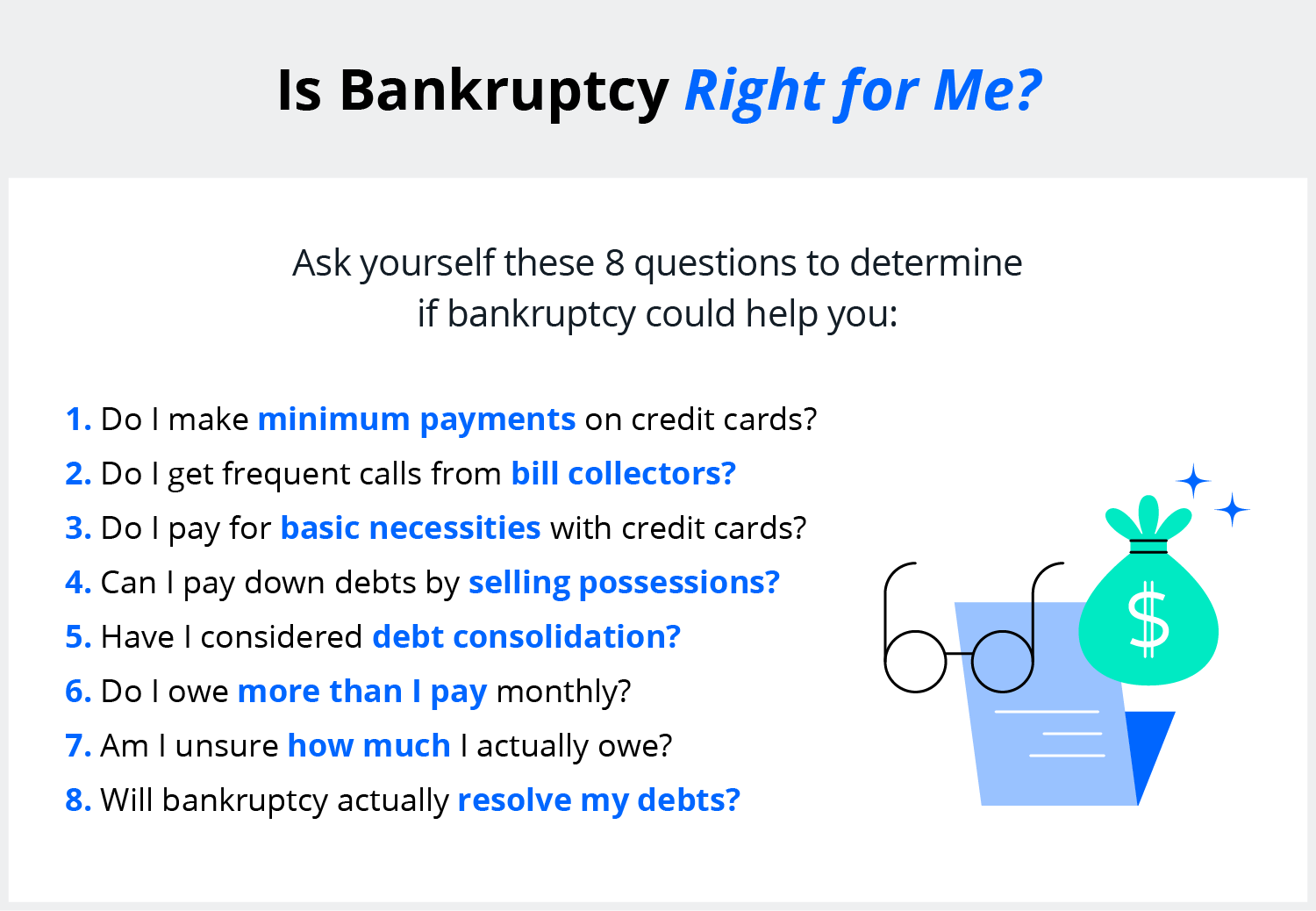

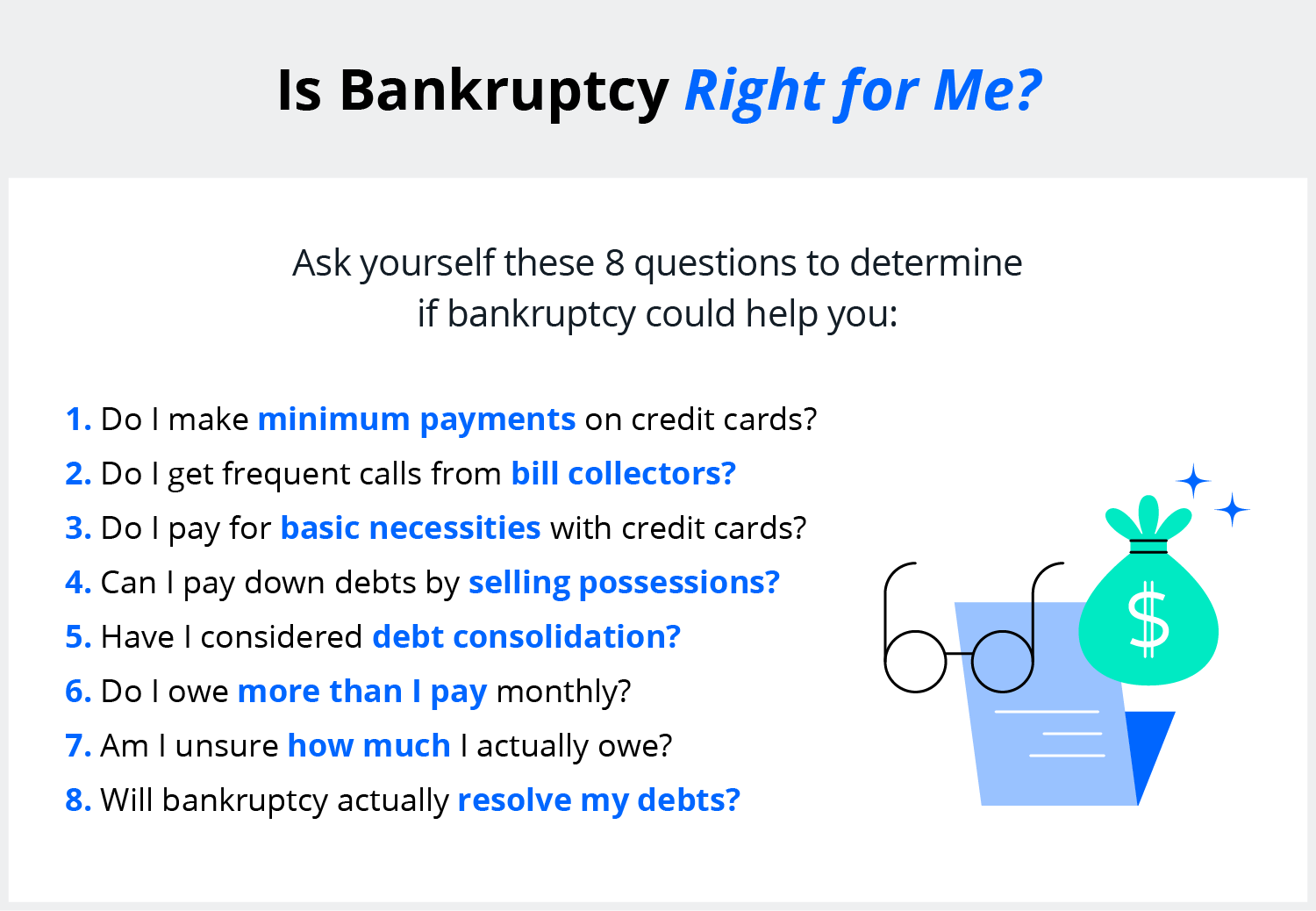

Browsing the intricacies of insolvency can be a daunting task for organizations and people alike. When economic obstacles loom large, looking for the help of bankruptcy services becomes vital in finding a way forward. These services provide a lifeline for those facing frustrating financial debt or economic distress, giving a variety of options tailored per unique scenario. Recognizing the intricacies of bankruptcy services and exactly how they can use the needed assistance is crucial to making notified decisions throughout difficult times. In exploring the numerous facets of insolvency solutions and the benefits they bring, a more clear path to economic stability and recuperation emerges.

Recognizing Insolvency Services

One secret aspect of recognizing bankruptcy services is recognizing the different bankruptcy procedures offered under the regulation. For individuals, alternatives such as private volunteer plans (IVAs) or bankruptcy might be considered, while companies might discover business volunteer setups (CVAs) or management. Each alternative includes its own collection of demands, implications, and possible outcomes, making it vital to look for professional assistance to make educated decisions.

Additionally, insolvency specialists can offer important recommendations on managing financial institutions, negotiating negotiations, and restructuring financial debts to achieve monetary stability. By comprehending insolvency solutions and the assistance they use, individuals and services can navigate difficult economic conditions with self-confidence and clearness.

Sorts Of Bankruptcy Solutions

What are the distinct types of bankruptcy solutions offered to people and services in economic distress? When confronted with bankruptcy, there are a number of paths that services and people can take to resolve their monetary difficulties. One typical insolvency solution is bankruptcy, which involves a lawful procedure where a private or organization declares that they are unable to settle their financial obligations. Business Insolvency Company. Through personal bankruptcy, possessions may be sold off to pay off creditors, providing a fresh begin for the individual or organization.

An additional bankruptcy service is a Specific Volunteer Setup (INDIVIDUAL VOLUNTARY AGREEMENT), a formal agreement in between a private and their financial institutions to settle financial obligations over a certain period. Individual voluntary agreements offer an organized way to manage financial debt while avoiding insolvency.

For businesses, administration is a kind of bankruptcy service that includes appointing an administrator to manage the business's events and job towards a recovery or organized ending up of the organization. This can aid services in economic distress restructure and possibly stay clear of closure. Each of these bankruptcy remedies uses a various method to solving monetary difficulties, dealing with the distinct needs of individuals and services dealing with insolvency.

Benefits of Looking For Specialist Assistance

Seeking expert aid when browsing insolvency can give individuals and businesses with expert guidance and anchor strategic solutions to properly manage their economic difficulties. Bankruptcy professionals bring a wealth of experience and understanding to the table, supplying customized suggestions based upon the certain conditions of each case. By employing the services of bankruptcy specialists, customers can take advantage of a structured method to fixing their monetary problems, making certain that all available alternatives are checked out and one of the most viable option is sought.

Moreover, expert bankruptcy practitioners have a deep understanding of the regulative and lawful structures bordering bankruptcy procedures. This experience can be important in making certain compliance with appropriate laws and laws, reducing the threat of costly blunders or oversights during the insolvency process.

Additionally, engaging professional help can aid reduce the stress and anxiety and burden related to bankruptcy, enabling services and individuals to focus on rebuilding their financial wellness (Business Insolvency Company). The support and support provided by bankruptcy specialists can impart confidence and quality in decision-making, empowering customers to navigate the intricacies of bankruptcy with greater convenience and efficiency

Significance of Timely Intervention

Having recognized the benefits of expert support in taking care of economic difficulties during bankruptcy, it becomes necessary to underscore the critical significance of timely intervention in such circumstances. By acting immediately and involving insolvency services at the earliest indicators of financial distress, people and services can access tailored options to address their specific needs and navigate the complexities of insolvency procedures a lot more successfully.

Timely treatment demonstrates a commitment to dealing with monetary difficulties responsibly and ethically, instilling confidence in stakeholders and cultivating trust fund in the bankruptcy process. In final thought, the significance of timely intervention in bankruptcy can recommended you read not be overstated, as it serves as a critical variable in figuring out the success of financial healing efforts.

Browsing Bankruptcy Treatments

Efficient navigation through insolvency treatments is crucial for people and organizations facing economic distress. Business Insolvency Company. When dealing with insolvency, recognizing the different procedures and requirements is critical to guarantee conformity and optimize the possibilities of an effective resolution. The initial step in browsing bankruptcy procedures is commonly examining the monetary situation and identifying the most ideal program of action. This might entail taking into consideration choices such as casual arrangements with creditors, becoming part of an official bankruptcy procedure like administration or liquidation, or checking out alternate solutions like Business Voluntary here Plans (CVAs)

Involving with insolvency specialists, such as certified bankruptcy professionals, can give valuable guidance throughout the process. These professionals have the expertise to aid browse intricate legal needs, connect with financial institutions, and develop restructuring strategies to attend to economic difficulties effectively. In addition, seeking very early guidance and treatment can aid reduce threats and enhance the possibility of a successful result. By comprehending and successfully browsing bankruptcy individuals, treatments and companies can function in the direction of resolving their monetary challenges and achieving a new beginning.

Verdict

In conclusion, insolvency solutions play a vital role in supplying necessary assistance and guidance during tough financial circumstances. By seeking expert assistance, services and individuals can browse insolvency treatments successfully and explore numerous options to address their monetary obstacles. Prompt intervention is type in staying clear of additional issues and safeguarding a better monetary future. Understanding the complexities of insolvency solutions can assist individuals make informed choices and take control of their financial well-being.

One secret aspect of recognizing bankruptcy services is recognizing the different insolvency procedures available under the regulation. Each of these insolvency solutions provides a various method to solving financial problems, catering to the unique needs of people and companies encountering insolvency.

Involving with insolvency professionals, such as licensed insolvency practitioners, can offer important assistance throughout the procedure.

Report this page